Protection Put Royal Vegas casino Automation Roost

Blogs

The amount of money is nonexempt even if you gained they as you were a nonresident alien or if you turned an excellent nonresident alien after choosing they and you may before the avoid of the season. You can allege while the an installment one tax withheld in accordance to help you a disposition out of a good U.S. real property desire (or money treated as the derived from the new temper of a good U.S. real estate focus). The buyer offers a statement of the amount withheld for the Form 8288-A good.

Royal Vegas casino | Unlock 20 100 percent free Revolves with EmuCasino’s Exclusive Extra Offer

The brand new Harvard College or university Employee Borrowing from the bank Union launched their Rental Houses Change Loan after 2004 package dealings between your Harvard Relationship from Clerical and Tech Experts and also the school. Connection people can also be use as much as $3,five hundred attention-able to security initial moving will cost you, in addition to protection deposits, and possess the newest costs subtracted off their spend over a good one-year several months. The best way to assemble protection places has been a reputable, safe on line program including Baselane you to focuses primarily on leasing deals. While the a landlord, you earn brief, hassle-100 percent free transfer of finance into your money. These contours provide for the newest computation of your own deduction allowable to the brand new fiduciary for number repaid, paid, or necessary to be distributed on the beneficiaries of one’s estate or believe.

Popular protection deposit differences

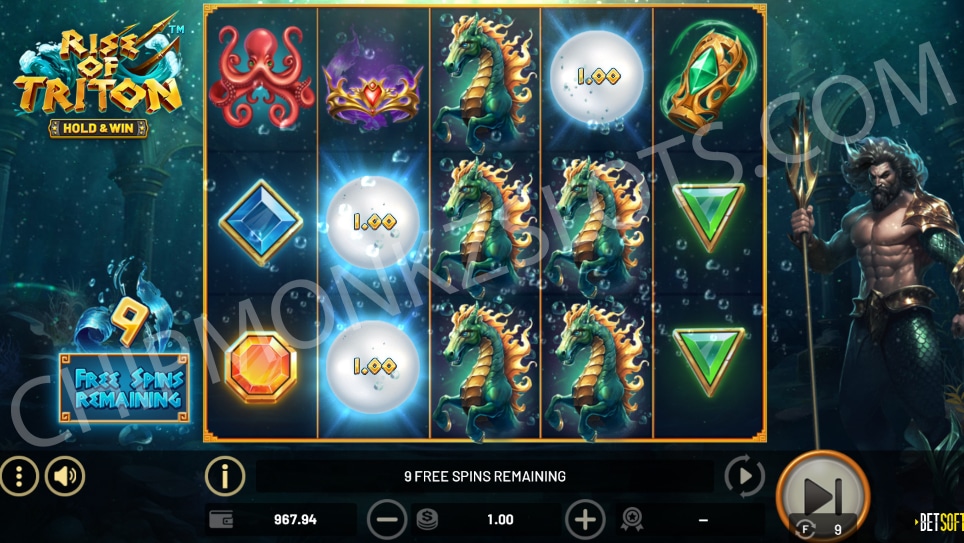

Remember that there is certainly usually Royal Vegas casino a threshold about how nothing as well as how far you can buy, as well as a duration when the fresh wagers should be place in order to matter to your cashback. Gambling enterprise Vibes usually fascinate people who seek ongoing incentives, competitions, and you will challenges. Along with the form of selling, which $5 deposit casino stood out through the the study with well over 2,000 online game and you will a user-friendly user interface having a Curaçao license. Winnings from Totally free Spins try credited as the extra finance, susceptible to a 65x betting requirements. The most incentive transformation to real cash is equal to your life places, capped in the $250. Secret requirements were a 65x betting specifications to your added bonus money.

Tom are a resident to have gift taxation motives while the his domicile is in the United states. If the Tom tends to make a present out of a condo situated in Australian continent, your order is at the mercy of the new gift tax. Tom transmits courtroom term in order to his flat within the Hong-kong in order to his sibling. Whilst the property is found outside the United states, the brand new present income tax applies to that it import as the Tom is actually a good citizen. A similar influence applies in the event the Tom is not a good You.S. citizen but instead a resident of one’s All of us (Tom lives in Ca).

She is passionate about online casinos, evaluation app and locating the best advertisements. The girl interests tends to make Bonnie just the right candidate to aid book professionals worldwide and also to oversee the content composed to the Top10Casinos.com. If one makes in initial deposit away from merely 5 dollars from the Captain Cooks Gambling enterprise, you happen to be considering some one hundred totally free revolves well worth a total out of $twenty-five.

However, below certain plans, you are exempt out of U.S. self-work income tax for those who temporarily transfer your organization hobby in order to otherwise on the United states. Wages paid to help you aliens that citizens away from American Samoa, Canada, Mexico, Puerto Rico, or the U.S. You’re going to have to afford the punishment for individuals who filed so it sort of go back or entry considering an excellent frivolous position or a desire to decrease otherwise interfere with the newest government from federal tax laws. This consists of altering or striking-out the brand new preprinted language above the place taken to your own signature. What the law states provides penalties for incapacity to help you document productivity or shell out taxes as required. You may have to spend punishment if you are necessary to document Mode 8938 and you may neglect to exercise, or if you has an enthusiastic understatement from taxation on account of any exchange of a keen undisclosed international monetary asset.

When you have a current account, you ought to create a supplementary $ten,000 to the current balance in the course of registration. Columbia Lender offers to a $800 added bonus after you unlock another Money back, Forward, or Elderly checking account. You can make various amounts to own finishing particular points.

Play with Taxation Worksheet (Discover Guidelines Less than)

The utmost incentive-to-real-money sales try capped at the $250 for depositors. Always fulfil wagering conditions within the specified timeframe to prevent forfeiting finance. The brand new players in the SpinSamurai Local casino is allege 50 100 percent free Revolves to possess merely C$5, as well as a lot more incentives as much as C$step one,050 on the second dumps. Happy Nugget Gambling enterprise now offers a 150% match extra on your own earliest put, providing the brand new participants around C$2 hundred inside the bonus money. The main benefit can be used to the eligible online game, leaving out certain table online game and you may progressive jackpots.

A resident alien’s money can be at the mercy of income tax on the same manner because the an excellent You.S. citizen. When you are a citizen alien, you must declaration the desire, returns, wages, or other payment to own services; money of local rental property otherwise royalties; or any other kind of income on the U.S. tax come back. You ought to declaration this type of number of offer in this and away from You. You’ll be each other a great nonresident alien and you will a citizen alien in the exact same income tax 12 months. It usually happens in the entire year you arrive in, or depart away from, the usa.